Life Insurance Corporation of India (LIC of India) is an Indian legal insurance and venture organization settled in the city of Mumbai, India. It is under the responsibility of India.

The Life Insurance Corporation of India was laid out on 1 September 1956, when the Parliament of India passed the life insurance of India Act which nationalized the insurance business in India. North of 245 insurance agencies and opportune social orders were converged to make the state-claimed Extra security Enterprise of India.

Starting around 2019, Extra security Corporation of India had an all-out life asset of ₹28.3 trillion. The all-out worth of sold arrangements in the year 2018-19 is ₹21.4 million. Life Insurance Corporation of India settled 26 million cases in 2018-19. It has 290 million arrangement holders.

History of LIC of India

Introduction of life insurance corporation of India

- The concept of life insurance was introduced in India under British rule in the year 1818.

- Coverage of Indian lives

In the year 1870, Bombay Mutual Life Assurance Society was formed which was the first Indian life insurance company. - Development of multiple companies

The Swadeshi Movement gave birth to a lot of indigenous insurance companies in India. By 1938, there were 176 insurance companies with an in-force business of INR 298 crores. - Need for nationalization of life insurance

Though there were ample companies, many were not financially sound and stable. The need for nationalization was felt and so, the Life Insurance Act, of 1938 was amended and, in 1956, life insurance was nationalized. - Formation of LIC

LIC was established on 1st September 1956 after Parliament passed the Life Insurance Corporation Act on 19th June 1956. Even though there are about two dozen life insurance companies in India, LIC continues to enjoy trust among individuals and holds the largest market share of the life insurance segment.

What is life insurance?

Life Insurance is an agreement between an insurance contract holder and a guarantor or assurer, where the safety net provider vows to pay an assigned recipient an amount of cash upon the passing of a safeguarded individual. Contingent upon the agreement, different occasions, for example, terminal sickness or basic disease can likewise set off installment. The strategy holder ordinarily pays a premium, either consistently or as one singular amount. The advantages might incorporate different costs, for example, burial service costs.

Life approaches are legitimate agreements and the particulars of each agreement depict the limits of the protected occasions. Frequently, explicit prohibitions composed into as far as possible the risk of the backup plan; normal models incorporate cases connecting with self-destruction, misrepresentation, war, revolt, and common upheaval. Troubles might emerge where an occasion isn’t characterized, for instance: the protected purposely brought about a gamble by consenting to a trial operation or by taking a prescription bringing about injury or passing.

Objectives of LIC of India

Some of the main objectives of the company are as follows –

- To sell life insurance policies not only in urban and developed areas but also in rural and economically backward areas where people need insurance cover. The company aims to provide affordable cover to all

- To make insurance attractive as a savings product so that people’s savings are mobilized

- To invest the policyholders’ funds in the best possible way so that the funds remain secure and provide attractive returns too

- To act as a trustee for policyholders

- To cater to the different insurance needs of individuals

- To promote a sense of belonging and pride in the minds of the agents and employees of the company.

The mission of the company

The company’s statement of purpose peruses as follows –

‘Guarantee and improve the personal satisfaction of individuals through monetary security by giving items and administrations of sought ascribes with cutthroat returns, and by delivering assets for the financial turn of events.’

About Life Insurance Corporation

Life Insurance Corporation of India (otherwise called LIC) is a state-held insurance supplier. Life Insurance Corporation of India began working in September 1956. life insurance Activities is the most established and one of the biggest life Insurance suppliers in India. life insurance corporation of India gives a wide scope of insurance plans like Term insurance, Entire Life, Blessing, and Cash Back Plans.

LIC has won a few honors, here is a portion of the honors introduced to LIC. Extra security Corporation was appraised as ‘Most Believed Administration Brand Of India’ by The Monetary Times Brand Value Administration in 2012. The company has ceaselessly been getting the ‘Peruser’s Review Confided in Brand’ grant starting around 2006. life insurance Enterprise has been cast a ballot ‘India’s Most Confided in Brand’ for four ceaseless years from 2011-to 2014.

Types of LIC Life Plans

The life insurance Corporation of India has a wide scope of thorough life Insurance plans. Following are the kinds of extra security plans presented by the insurance agency:

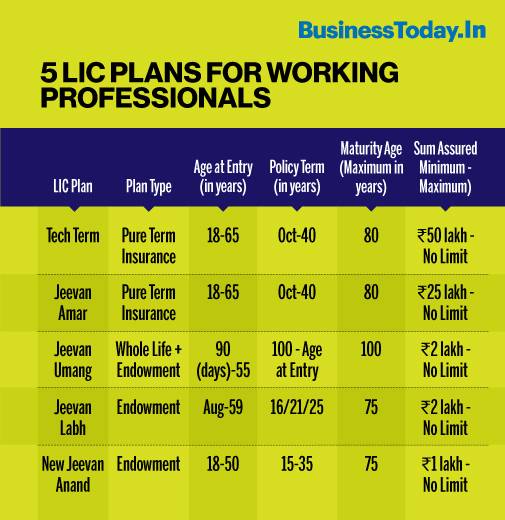

- Term Insurance Plans: Life Insurance Corporation offers two-term insurance plans. LIC’s Tech Term is pure protection and an online term plan that provides financial protection to the family of the policyholder on the unforeseen demise of the policyholder. LIC’s Jeevan Amar offers life cover and flexibility to choose from two death benefits offered Level Sum Assured and Increasing Sum Assured.

- Endowment Plans: Life Insurance Corporation offers several endowment plans namely LIC’s Saral Jeevan Bima, LIC’s Bima Jyoti, LIC’s Bachat Plus, LIC’s New Endowment Plan, LIC’s New Jeevan Anand, LIC’s New Bima Bachat, LIC’s Single Premium Endowment Plan, LIC’s Jeevan Lakshya, LIC’s Jeevan Labh, LIC’s Aadhaar Stambh, and LIC’s Aadhaar Shila.

- Whole Life Plans: Life Insurance Corporation offers only one whole life plan i.e LIC’s Jeevan Umang this plan offers income and protection. LIC’s Jeevan Umang offers survival benefits after the premium paying term ends till the policy maturity date and this plan also offers a lump sum amount at the time of maturity/death of the policyholder.

- Money-Back Plans: Life Insurance Corporation offers several money back plans namely LIC’s New Money Back Plan-20 Years, LIC’s New Money Back Plan-25 Years, LIC’s Jeevan Umang, LIC’s New Children’s Money Back Plan, LIC’s Jeevan Tarun, LIC’s Jeevan Shiromani, and LIC’s Bima Shree.

Significant Facts About Life Insurance Corporation Of India

Before buying a life insurance strategy from LIC, you ought to be familiar with certain realities about the insurance agency. Underneath referenced is a rundown of realities that one ought to know about before buying a life Insurance plan presented by LIC:

- LIC is one of the oldest government-owned insurance companies that has been providing life insurance for the last 59 years.

- LIC has been operating at a multinational level, as of now, the insurance company is operating in Fiji, UK, Mauritius, Singapore, Bangladesh, Bahrain, Dubai, Abu Dhabi, Oman, Qatar, Kuwait, Saudi Arabia, Sri Lanka, Kenya, and Nepal.

- LIC invests most of its funds in bonds (government and corporate) and some funds in stock markets. The return on investments is partly provided to policyholders and the remaining is utilized by the government of India (95% of the returns on investment are provided to policyholders).

- LIC has more than 11 Lakhs agent network that helps in the distribution of life insurance policies.

- Since LIC is a government-run insurance company, the government guarantees to settle claims in case it defaults.

- LIC is a very customer-centric insurance provider. The slogan of LIC ‘Yogakshemam Vahamyaham’ from Bhagavad Geeta means ‘Your welfare is our responsibility.’

Features And Benefits Of LIC Life Insurance Plans

Beneath referenced are a few highlights and advantages that one can profit from under a LIC extra security strategy:

- Provide Financial Security – When you choose to purchase a life insurance policy from LIC, you can ensure the financial security of your loved ones in your absence. LIC life insurance policy provides financial security to the family of the life assured in case of unforeseen demise of the life assured during the policy tenure.

- Tax Benefits – One can avail of tax benefits by investing in a LIC life insurance policy. Premiums paid for LIC life insurance policy qualify for tax exemptions under Section 80C and 10(10D) of the Income Tax Act.

- Hassle-free Claim Settlement – As LIC is a state-run insurance company, settling claims on time without any hassles is the one major thing that the insurance company focuses on. One does not need to worry about the claim not being settled on time. This is the one major advantage of purchasing a LIC life insurance policy.

- Variety of Life Insurance Plans – LIC offers a variety of life insurance plans to choose from. You can choose to purchase a Whole Life, Term, Money Back, Endowment, ULIP. You can choose a life insurance plan according to your requirements and budget.

Why Choose LIC?

Life Insurance Enterprise of India notable as LIC is an administration-run insurance agency. The insurance agency has been giving a wide scope of extra security plans for quite a while. LIC is the most established extra security company in India. LIC offers a wide scope of life Insurance items intended to satisfy various prerequisites of various individuals. LIC was laid out with a fundamental target of giving monetary security to individuals. LIC life insurance strategies are an extremely well-known decision among clients. LIC is one of the most believed life insurance Corporation of India.

Modes Of Payment Options Offered By LIC

LIC policyholders have an option to pay premiums online or offline. Below mentioned are different modes of payment options offered by LIC:

1. Online Payment Options:

Following is the list of online payment options offered by LIC:

- LIC’s Official Website

- E-Wallets (Paytm, BHIM, etc.)

- UPI

- Debit/Credit Cards

- Net Banking

2. Offline Payment Options:

Following is the list of offline payment options offered by LIC:

- Direct Payment at

- NACH

- Bill Pay

- ATM – Axis and Corporation Bank

Claiming Insurance With LIC

Since Life coverage Partnership of India is a state-run insurance agency, settling claims on time is the best office presented by the insurance agency to its clients. The insurance agency helps in Claiming a problem-free case settlement for its clients.

As a candidate of a LIC policyholder, who has died, you ought to know about the whole case process beginning from recording a case Intimation to Claim settlement. The whole case settlement process is disconnected, the candidate needs to visit the branch office to record a case for the LIC insurance contract. Underneath referenced is the bit by bit manual for documenting a passing case with LIC:

Guarantee Intimation – in the event of an unanticipated end of the existence guaranteed, the chosen one is expected to visit the branch office of Extra security Enterprise of India to imply the insurance agency concerning the case. The branch office will give guarantee structures and NEFT structure which is to be filled by the candidate. The NEFT structure is expected for the exchange of the demise benefit into the candidate’s bank account. The candidate needs to give an implication letter under which date of destruction, a spot of the end, and a reason for the end of the policyholder.

Submit Required Archives – The candidate needs to submit supporting reports which are expected to survey the case. All supporting records that the candidate will submit are to be self-authenticated. Do remember that while surveying the case LIC can request extra reports before the case is at long last settled.

Guarantee Settlement – When the chosen one has presented the reports gather the affirmation slip. The chosen one will get the case sum will be settled in somewhere around 30 days if no extra archives are required. If the case sum isn’t settled in any less than 30 days, the candidate can visit the branch office to look at the situation with the case.

Important Documents For Purchasing LIC Life Insurance Policy

Mentioned below is the loss of important documents required to purchase a LIC life insurance policy:

1. Identity Proof

- Aadhaar Card

- Passport

- Voter ID Card

- PAN Card

2. Age Proof

- Driving License

- Voter ID Card

- Marriage Certificate

- Birth Certificate

3. Address Proof

- Passport

- Ration Card

- Aadhar Card

- Latest 3 electricity, water, or any other utility bills

3. Income Proof

- Latest 6 salary slips

- Income Tax Returns for the last 2 years

- Bank statements for the last 6 months stating 3 months of salary credited continuously

- Form 16

4. Other Documents

- Proposal Form

- Policy Declarations in case the application form has not been filled by the policyholder itself

- Final Declaration stating that information provided is true and correct.

How To Check LIC Policy Status?

LIC offers various administrations online to smoothen the experience for its clients. Looking at your extra security strategy status now and then is all around as significant as buying a life coverage strategy.

If you are another client, you should enroll for e-administrations on the home of LIC’s true site, you will be expected to fill a web-based enlistment structure to make your login accreditations. When you have effectively enlisted an affirmation email will be shipped off your enrolled email address, and you will get a URL interface that diverts you to a page where you can connect your disaster Insurance strategy to your client account. On this page, you want to give subtleties, for example, strategy number, date of birth, premium sum, and so on, and click on ‘Submit’ to continue. The situation with strategy will be shown in a split second as you present the data given.

Underneath reference are a few stages that one should follow to check the approach status of their LIC life coverage strategy on the web:

- Step 1 – Visit the official website of the e-service portal of LIC.

- Step 2 – Click on ‘New User’ in case you haven’t already registered, if you have already registered then click on ‘Registered User.’ (You can follow the above-mentioned steps to register yourself)

- Step 3 – An external link will open where you need to enter your UserID/Email/Mobile Number, Password, and Date of Birth.

- Step 4 – Once you have successfully logged in, click on the ‘Policy Status’ tab.

- Step 5 – Click on the policy number to get your policy status.

You can also check your policy status offline by calling the helpline number of LIC or by sending an SMS. To get your policy status through SMS simply send ASKLIC to 56767877 or 9222492224 from your registered mobile number.

LIC Online Payment

You can now make LIC premium Payments online effectively and safely anyplace and whenever. You can make payments online on the LIC e-administrations entry. Underneath reference is a means to make the Payment online on the gateway:

- Step 1 – Visit the official website of LIC and select ‘Pay Premium Online’ from the ‘Online Services’ section on the home page.

- Step 2 – You can choose to pay without logging in or through the customer portal. If you want to pay without login, select ‘Pay Direct’ and if you want to pay through the customer portal then select ‘Through Customer Portal.’

- Step 3 – In case you select ‘Pay Direct’ a new window will open under which you can select the type of payment such as Renewal, Advance Premium Payment, Loan Repayment, or Loan Interest Repayment. After selecting the type of payment you must fill out the customer validation form, verify your premium particulars and proceed to make the payment.

- In case you want to pay a premium through the customer portal, you will have to log in using your User ID/Email/Mobile, Password, and Date of Birth.

- Step 4 – Provide your policy number and amount of the premium payable. Select the policy and procedure to make the payment.

LIC Premium Calculator

If you have any desire to gauge how much expense for a LIC life coverage strategy before buying an insurance contract, you can follow these means:

- Step 1 – Visit the official e-services portal of LIC and click on the ‘Premium Calculator and Benefit Illustration’ option.

- Step 2 – Enter the required information such as your name, date of birth, age, gender, mobile number, and email address then click on ‘Next’

- Step 3 – You can choose to get a quick quote or compare quotes. Select the name of plans you want to compare or select the name of the plan you want to get a quick quote.

- Step 4 – Enter your preferred sum assured, policy term, and policy tenure then click on ‘Next’.

- Step 5 – Premium for the insurance policy will be calculated based on a yearly, half-yearly, quarterly, and monthly basis. You can choose the premium payment frequency of your plan and click the ‘Get Illustration’ benefit illustration.

That was it for this article. If you found it helpful, consider checking out our blog STORIFYGO!